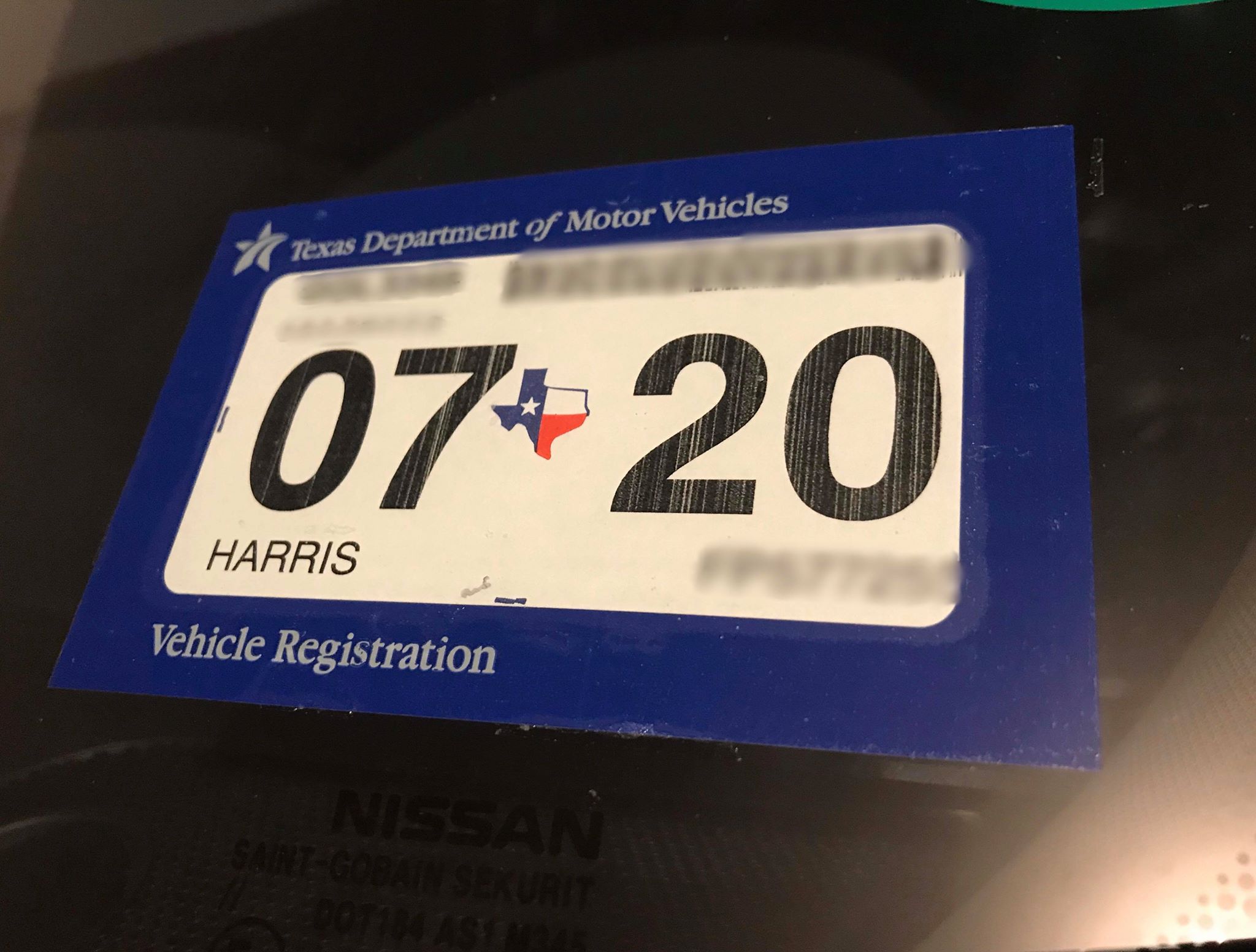

Enrollment Renewal Grace Periods: The Length Of Time Do You Have? Many students do not bring their cars, yet long-term army and their partners do. The Texas Division of Motor Vehicles has unique guidelines for armed forces personnel vehicle registration. To recognize the lorry you wish to sign up, please enter your vehicle's certificate plate number and the last 4 numbers of your Lorry Recognition Number. This write-up was created by Jennifer Mueller, JD and by wikiHow personnel author, Christopher M. Osborne, PhD. Jennifer Mueller is an internal lawful specialist at wikiHow. Jennifer evaluates, fact-checks, and reviews wikiHow's lawful material to guarantee thoroughness and precision. She obtained her JD from Indiana College Maurer Institution of Law in 2006. Enrollment expires on the last day of the month revealed on your sticker label. For example, if your sticker shows a day of 12/23, your registration is valid through the last day of December 2023. Your automobile tag is the registration sticker offered to you annually. You place it on the permit plate or windscreen of your lorry, relying on your regional state regulations. Each automobile tag shows the month and year that your car is registered via. If a motorist hasn't received any citations, they can renew online, by mail or face to face any time up to 90 days past the renewal date. Additionally, new electrical automobiles issued 2 years of registration to match a two-year examination will be assessed a $400 charge. All basic lorry enrollment and associated costs still use. Some regions use renewals at substations and subcontractors, such as a getting involved grocery store. If you are renewing your enrollment at a region subcontractor location, such as your neighborhood food store, they may decline your VIR as evidence of evaluation. Each county figures out whether their subcontractors can confirm examination by hand with a VIR. You might get a replacement sticker from your neighborhood region tax obligation assessor-collector's office for a $6 replacement fee plus the $0.50 automation fee. You may be required to complete and send an Application for Substitute Automobile Registration Sticker (Kind VTR-60) to your neighborhood area tax obligation office. You have to register your car in the state or territory where you presently live, unless you are a full time trainee or active military. If you are a trainee or active armed forces, call your regional area tax office in the Texas region where you last lived for more information. Completely electric cars and trucks and vehicles, with a gross vehicle weight VIN Inspection of 10,000 lbs. Or less, will certainly be assessed a yearly $200 cost at the time of registration renewal starting September 1, 2023. The vehicle's record or possession has actually altered because the renewal notification was sent. All credit/debit card purchases consist of an extra 1.95% settlement processing cost. Larger, much heavier automobiles typically pay much more road-use tax than lighter automobiles.

- What, precisely occurs when your enrollment ends then?You can stay clear of complications by going to a federal government outlet to restore.Some states calculate costs as a percentage of your car real estate tax.You can still renew your Texas enrollment online, by mail or in person without the examination.All counties might likewise evaluate a youngster safety fee of as much as $1.50 to advertise kid security programs consisting of health and wellness and nourishment education and learning and school crossing guards.

How To Register Your Lorry And Obtain Texas Plates

For preliminary issuance of enrollment plates, a consumer may select a two-year registration duration. Additionally, enrollment revival vouchers with an April 2017 expiry day or later on will certainly include both the one-year and the two-year registration costs. If the cost noted in the "2-yr fee" block on the enrollment renewal form is shaded grey that car type is not eligible to renew for a two-year period. On top of that, car owners that pay a processing cost in lieu of registration are not eligible for a two-year enrollment period. When you renew your car registration, many states bill a registration cost as well as different taxes for road use and law enforcement. In fact, certain states, like Massachusetts and Indiana allow insurance providers to cancel policies if an automobile's enrollment is revoked. If you are qualified for a 'no fee' enrollment, you will certainly need to restore at a workplace. You will require to bring documentation to prove you are eligible for excluded status. All bike enrollments end on April 30, You have to restore your motorbike registration for the existing year prior to you can renew for the following year. If you intend to store and not run your vehicle during the next revival year, you may declare Planned Nonoperation online. You are restoring a business car signed up through the International Enrollment Plan.Is There A Grace Period For Expired Tags In Ohio? - J.D. Power

Is There A Grace Period For Expired Tags In Ohio?.

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

Car Management

To validate your most updated vehicle enrollment standing, contact your state's DMV online, by phone, or in person. Prior to your lorry registration runs out, you'll require to restore it with your state's Department of Electric motor Cars, Assistant of State, Division of Revenue Lien Foreclosure Sale or Motor Vehicle Department. As soon as your registration ends, you can be hit with late charges that vary by area and range anywhere from $4 to upwards of $20. Some states calculate costs as a portion of your automobile real estate tax.Expired vehicle registrations: Driving Me Crazy - KGW.com

Expired vehicle registrations: Driving Me Crazy.

Posted: Thu, 19 May 2022 07:00:00 GMT [source]